Our Perspective.

“HEALTHCARE INVESTING IS ABOUT BEING ABLE TO SEE THE FUTURE AND WHAT IT HOLDS FOR HUMANITY.” ~ Bill Gates

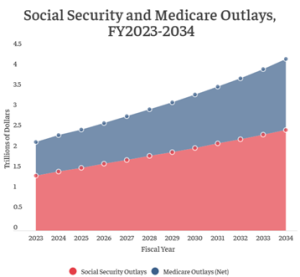

Our quality of life today is significantly better than that of our grandparents. Indeed, our quality of life is not only better, but we live longer and experience significantly more than our ancestors. However, societies are also experiencing greater levels of illness, labour forces are shrinking, and inequality continues to rise. These demographic trends mean greater strain on governments and healthcare systems, with healthcare costs set to explode over the next decade. In the US alone, Medicare coverage is set to grow from $900bn in 2024 to $1.75tr in 2034. Whilst this represents only a 7% CAGR, it will significantly outpace GDP growth.

But this is also exactly the reason why investors should look for opportunities in healthcare. The need for change is the mother of innovation. And innovation is accelerating.

The life sciences industry is on the brink of extraordinary transformation, underpinned by the powerful convergence of genomics, robotics, and AI. We believe we are at the dawn of a new era in medical breakthroughs. A mix of integrating AI into R&D processes, supply chain shifts and innovation in therapeutic areas such as neurology, obesity, and oncology, are fuelling a resurgence of M&A activity and the IPO market following the depression of 2022 and 2023.

Exhibit 1: The extraordinary growth of social security and Medicare costs in the USA over the next decade, as projected by the CBO, will likely be funded by increasing debt and deficits:

Source: CBO, https://bipartisanpolicy.org/blog/visualizing-cbos-budget-and-economic-outlook/, 23/02/2024

Exhibit 2: Four economic scenarios according to Oliver Wyman analysis, with the most likely outcome somewhere between scenario 3 and scenario 4, in our opinion:

Source: Oliver Wyman analysis, health.oliverwyman.com

New business models will emerge whilst the biggest winners are likely to be those companies who are able to win consumers through brand loyalty and engagement. Undoubtedly many of these companies are still in the early stages of their life cycle or private companies in venture capital markets. But there might equally be opportunities in large, listed blue chips, and everything in between. A good example is the opportunity for GLP-1’s, which we discussed in a recent podcast, which you can listen to here. The extraordinary successes of early incumbents Novo Nordisk and Eli Lilly are severely underexploited due to supply shortages.

What is clear is that the opportunity cannot be taken advantage of through a passive or index-tracking fund, but rather investors will have to embrace active management. Investment teams will need a strong understanding of the science, the manufacturing and distribution risks, and the increasingly difficult regulatory environments these companies operate in. Sure, pricing pressures will likely remain, supply chains remain fragile which means volatility should be expected. But the opportunity for long term, patient investors into the Life Sciences space has never been more exciting!

To view our graphs and data tables, please download the full article below.

Disclaimer:

We try to ensure that the information provided is correct, but we do not give any express or implied warranty as to its accuracy. We do not accept any liability for errors or omissions. The content of this brochure is for guidance purposes only and does not constitute financial or professional advice.

This document has been prepared and issued by Shard Capital (Jersey) Limited (“Shard Capital”). Shard Capital is a limited company (reference no. 130205) with its registered office at 3rd Floor, 5 Anley Street, St Helier, Jersey JE2 3QE. Shard Capital is authorised and regulated by the Jersey Financial Services Commission for Investment Business under the Financial Services (Jersey) Law 1998.

*Source:

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

IMPORTANT INFORMATION

Shard Capital (Jersey) Limited is an associated company of Shard Capital Partners LLP, a limited liability partnership, registered in England with registration number OC360394. Shard Capital Partners LLP Registered office: 36-38 Cornhill, London, EC3V 3NG. Shard Capital Partners LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom, reference number 538762.

This document is provided for information purposes only and is intend for confidential and sole use by the recipient. It is not to be reproduced, copied or made available to others. The information set out in this document does not constitute investment advice or a personal recommendation. The views expressed in this document are not intended as an offer or a solicitation, to purchase or sell any security or other financial instrument, credit or lending product or to engage in any investment activity.

Past performance is not a guide to future performance. It is important that you understand that with investments, your capital is at risk. The value of investments, as well as the income derived from them, can go down as well as up and investors may get back less than the original amount invested. It is your responsibility to ensure that you make an informed decision about whether to invest with us, based on your particular objectives. If you are still unsure if investing is right for you, please seek independent advice.

The information and opinions expressed within this document are the views of (the company) and are based on information we believe to be reliable, but we do not represent that they are accurate or complete, and they should not be relied upon as such. Any information provided is given in good faith but is subject to change without notice.

No liability is accepted whatsoever by (the company) or its employees and associated companies for any direct or consequential loss arising from this document.